Arkstream Capital: In 2025, When Crypto Assets Return to "Financial Logic"

- Core View: In 2025, the crypto market shifts to being dominated by external variables and competition for financial entry points.

- Key Elements:

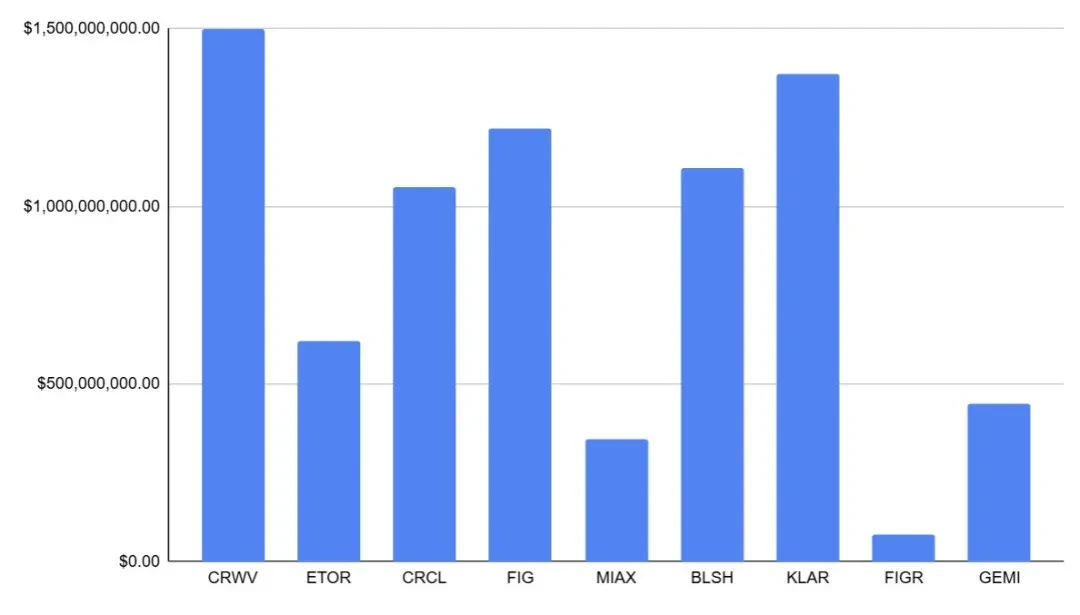

- Crypto company IPOs resume, raising $77.4 billion, providing a compliant valuation anchor.

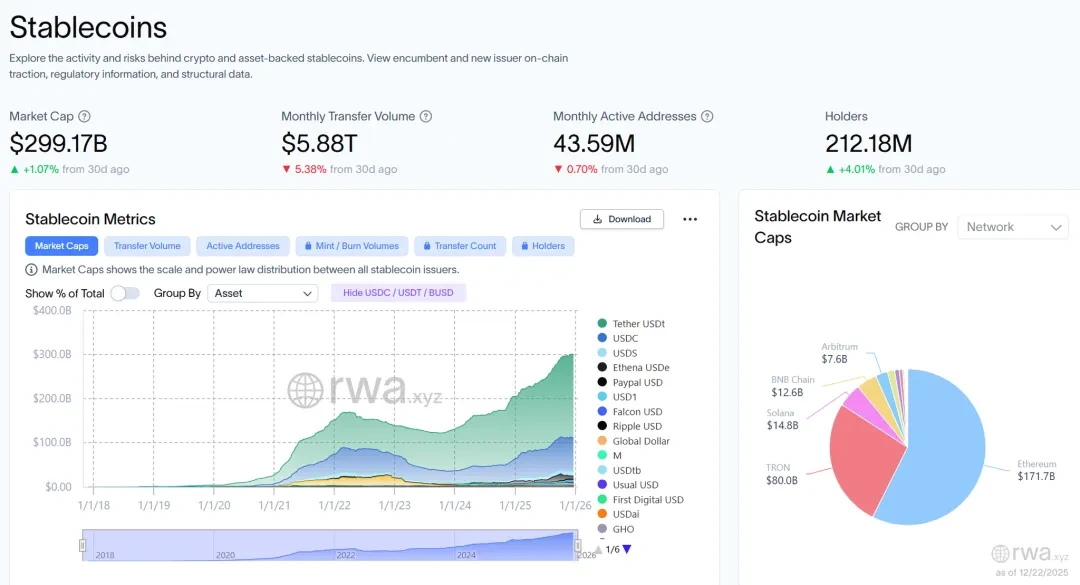

- Stablecoin supply increases to $3 trillion, solidifying the foundation for on-chain dollar settlement.

- On-chain derivatives and prediction markets (e.g., event contracts) become significant incremental use cases.

- Market Impact: Industry pricing and capital structures become more deeply integrated into the traditional financial system.

- Timeliness Note: Medium-term impact

In 2025, the main narrative of the crypto market no longer revolves around the technological cycle of a single public chain or the self-contained loop of on-chain narratives. Instead, it has entered a deeper stage dominated by "external variable pricing and competition for financial entry points." Policy and compliance frameworks determine the access boundaries for long-term capital; macro liquidity and risk appetite determine whether trends can be sustained; and derivatives leverage and platform risk control mechanisms reshape the patterns of volatility and the speed of drawdowns at critical junctures. More importantly, a key theme repeatedly validated by the market starting in 2025 is: what determines price elasticity is no longer just the "strength of on-chain narratives," but rather through which entry points capital flows, onto which investable assets it lands, and how it exits under pressure. The combined force of external variables and internal evolution has driven the transformation of the crypto industry in 2025, further solidifying two clear paths for its future development.

Institutionalization Acceleration and Securitization Breakthrough: The Era of External Variables Dominating the 2025 Crypto Market

"Financialization" underwent a structural shift in 2025. The ways capital enters are no longer limited to on-chain native leverage but have diversified into multiple, clearly layered parallel channels. Crypto allocation has expanded from a single "asset exposure (spot/ETF)" to a dual-track structure of "asset exposure + industry equity." Market pricing has also shifted from a single-axis driven by "narrative-positioning-leverage" to a comprehensive framework of "institution-capital flow-financing capacity-risk transmission."

On one hand, standardized products (like ETFs) incorporate crypto assets into the risk budgeting and passive allocation frameworks of investment portfolios; the expansion of stablecoin supply solidifies the on-chain dollar settlement base, enhancing the market's endogenous settlement and turnover capacity; corporate treasury (DAT) strategies directly map the financing capacity and balance sheet expansion of listed companies into spot demand functions. On the other hand, crypto companies are securitizing their licenses, custody, trading/clearing, and institutional service capabilities into listed company stocks through IPOs. This allows institutional capital, for the first time, to invest in the cash flows and compliance moats of crypto financial infrastructure in a familiar way, introducing a clearer benchmarking system and exit mechanism.

IPOs play the role of "buying the industry, buying cash flows, buying compliance capabilities" within the capital structure. This path was rapidly established in 2025, becoming a preferred choice for leading crypto companies and an external variable for the crypto industry.

In the five years prior, this path was not yet clear. The reason was not that public markets formally closed to crypto companies, but that going public was, in practice, long characterized by "high barriers, difficult pricing, and challenging underwriting": On one hand, unclear regulatory stances combined with intense enforcement meant core businesses like trading, brokerage, custody, and issuance had to endure higher-density disclosures of legal uncertainty and risk discounts in IPO materials (e.g., the SEC's 2023 lawsuit against Coinbase, accusing it of operating as an unregistered exchange/broker/clearing agency, reinforced the uncertainty of "business nature potentially being retroactively defined"). On the other hand, stricter accounting and auditing standards for presenting capital and liabilities in custody-like businesses also raised compliance costs and barriers to institutional cooperation (e.g., SAB 121 imposed stricter asset/liability presentation requirements for "custodying crypto assets for clients," widely seen by the market as significantly increasing the asset burden and audit friction for financial institutions engaging in crypto custody). Simultaneously, industry credit shocks combined with macro tightening led to a contraction in the overall U.S. stock IPO window, causing many projects to prefer delaying or changing course even if they wanted to access public markets (e.g., Circle terminating its SPAC merger in 2022, Bullish halting its SPAC listing plan in 2022). More crucially, from an execution perspective in primary markets, these uncertainties were amplified into real "underwriting friction": underwriters needed to conduct stress tests during the project initiation phase through internal compliance and risk committees on whether business boundaries might be retroactively defined, whether key revenue streams could be reclassified, whether custody and client asset segregation introduced additional balance sheet burdens, and whether potential enforcement/litigation triggered significant disclosure and indemnity risks. Once these issues were difficult to explain in a standardized way, it led to significantly higher due diligence and legal costs, longer risk factor sections in prospectuses, unstable order quality, and ultimately reflected in more conservative valuation ranges and higher risk discounts. For issuing companies, this directly altered strategic choices: rather than pushing forward in an environment of "high explanation costs, suppressed pricing, and uncontrollable post-listing volatility," it was better to delay the offering, turn to private financing, or seek M&A/other paths. These constraints collectively determined that, at that stage, IPOs were more like a "choice" for a few companies rather than a sustainable financing and pricing mechanism.

The key change in 2025 was precisely the clearer "removal/easing" of the aforementioned resistance, restoring a continuous expectation for the IPO path. One of the most representative signals was the SEC's issuance of SAB 122 and rescission of SAB 121 in January 2025 (effective that month), directly removing the most controversial and "asset-heavy" accounting obstacle for institutions participating in custody and related businesses, improving the scalability of the bank/custody chain, and reducing the structural burden and uncertainty discount for related companies at the prospectus level. Around the same time, the SEC established a crypto asset working group and signaled progress towards a clearer regulatory framework, lowering the uncertainty premium in expectations regarding "whether rules will change or be applied retroactively." Mid-year legislative progress in the stablecoin domain further provided "framework-level" certainty, making key segments like stablecoins, clearing, and institutional services easier for traditional capital to incorporate into valuation systems in an auditable, benchmarkable way.

These changes rapidly transmit along the execution chain of the primary market: For underwriters, it becomes easier to transform compliance conditions from "inexplicable, unpricable" to "disclosable, measurable, benchmarkable"—conditions that can be written into the prospectus and compared horizontally by buyers. Underwriting syndicates can then more easily provide valuation ranges, manage the issuance pace, and commit research coverage and distribution resources. For issuing companies, this means an IPO is no longer just a "financing event" but a process of engineering revenue quality, client asset protection, internal controls, and governance structures into "investable assets." Furthermore, although U.S. markets don't have a formal "cornerstone investor" system like Hong Kong, anchor orders and long-term accounts (large mutual funds, sovereign wealth funds, some crossover funds) during book-building functionally play a similar role: when regulatory and accounting friction eases and industry credit risks are cleared, higher-quality demand is more likely to return to the order book, helping stabilize pricing and ensure more continuous issuance, thus making IPOs more likely to return from "sporadic windows" to a "sustainable financing and pricing mechanism."

Ultimately, marginal improvements in policy and accounting standards are concretely mapped onto the rhythm of the year's market movements and capital flow directions through the primary market and capital allocation chain. Viewed through the unfolding of 2025, these structural changes became more visibly apparent in a relay-like fashion.

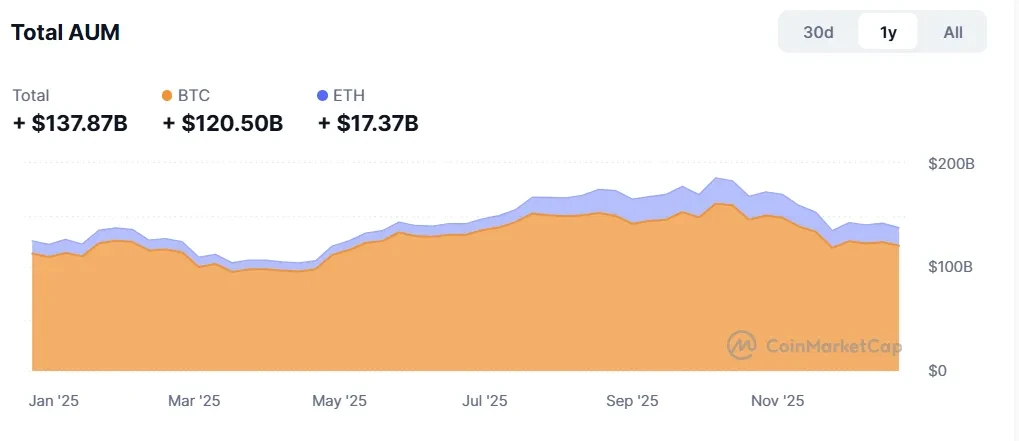

Early 2025 saw the convergence of regulatory discounts driving a reassessment of institutional expectations, with core assets benefiting first due to clearer allocation paths. Subsequently, the market entered a period of repeated confirmation of macro hard boundaries, where interest rate paths and fiscal policy embedded crypto assets deeper into the volatility models of global risk assets (especially U.S. tech/growth stocks). By mid-year, the reflexivity of DATs became more apparent: the number of listed companies adopting similar treasury strategies rose to the hundreds, with combined holdings reaching the hundred-billion-dollar scale, making balance sheet expansion a significant source of marginal demand. Simultaneously, increased treasury allocations related to ETH meant the "balance sheet expansion—spot demand" transmission was no longer solely centered around BTC. In the third and fourth quarters, against the backdrop of multiple parallel channels and capital rebalancing between different entry points, the valuation benchmarks and issuance conditions in public markets began to more directly influence capital allocation within the crypto sector: whether issuances proceeded smoothly and whether pricing was accepted gradually became barometers for measuring "industry financing capacity and compliance premium," indirectly transmitting to spot pricing through capital reallocation between "buying tokens/buying stocks." As transactions like Circle's provided a "valuation anchor" and more companies advanced IPO filings and preparations, IPOs evolved further from "pricing references" into a core variable influencing capital structure: ETFs primarily address the question of "whether and how to allocate to a portfolio," while IPOs further address "what to allocate, how to benchmark, and how to exit," pushing some capital from the high-turnover on-chain leverage ecosystem towards longer-term industry equity allocations.

More importantly, this "entry point competition" is not just a theoretical framework but can be directly observed in capital data and market behavior. As the on-chain dollar settlement base, stablecoin supply expanded from around $2.05 trillion to the $3 trillion range in 2025, stabilizing near year-end, providing a thicker settlement and liquidity buffer for on-chain transaction expansion and deleveraging processes. ETF capital flows solidified into explicit pricing factors; despite macro volatility and institutional rebalancing disturbances, IBIT still achieved approximately $25.4 billion in net inflows for the year, increasing the explanatory power of "net flow/rebalancing rhythm" on price elasticity. The scaling of DATs meant listed company balance sheets began directly impacting spot supply-demand structures, potentially reinforcing trend expansion during uptrends, while also potentially triggering reverse transmission during downtrends due to valuation premium contraction and financing constraints, thereby coupling the volatility of traditional capital markets with crypto markets. Simultaneously, IPOs provided another set of quantitative evidence: a total of 9 crypto/crypto-related companies completed IPOs in 2025, raising approximately $77.4 billion in aggregate, indicating that the public market financing window not only exists but possesses real capacity.

Source: rwa.xyz / Stablecoin Growth in 2025

Source: CoinMarketCap / ETF Full-Year Fund Flow Data

Source: Pantera Research Lab / DAT Data

Against this backdrop, IPOs became an "external structural variable" for the 2025 crypto market: on one hand, they expanded the range of investable assets for compliant capital, providing public market valuation anchors and benchmarking systems for segments like stablecoins, trading/clearing, brokerage, and custody, and altered capital holding periods and exit mechanisms through the "stock" form. On the other hand, their marginal increments are not linear and remain constrained by macro risk appetite, secondary market valuation benchmarks, and issuance windows.

Summarizing the full year, 2025 can be characterized as a combination year of "accelerated institutionalization, strengthened macro constraints, and securitization restart": progress in institutional and compliance paths enhanced the allocatability of crypto assets, expanding capital entry points from a single on-chain structure to a parallel system of ETFs, stablecoin base, DATs, and IPOs. Simultaneously, interest rates, tariffs, and fiscal friction continuously shaped liquidity boundaries, making market movements more akin to "macro-driven volatility" of traditional risk assets. The resulting sector differentiation, along with the return of the "listed company vehicle," will form an important prelude to 2026.

IPO Window Recovery: From Narrative Premium to Financial Primitive

In 2025, the U.S. stock IPO window for crypto-related companies clearly recovered, evolving from a "conceptual window opening" into a set of public market samples that can be quantitatively examined: based on the sample scope, a total of 9 crypto/crypto-related companies completed IPOs throughout the year, raising approximately $77.4 billion in aggregate. This indicates that public markets have restored considerable financing capacity for "compliantly accessible digital financial assets," not just symbolic small offerings. In terms of valuation, this set of IPOs covered a range from approximately $1.8 billion to $23 billion, essentially spanning stablecoins and digital financial infrastructure, compliant trading platforms and trading/clearing infrastructure, regulated brokerage channels, and on-chain credit/RWA and other key segments. This gives the industry a trackable, benchmarkable pool of equity asset samples for the first time. This not only provides valuation anchor points for the "stablecoin—trading—brokerage—institutional services—on-chain credit/RWA" chain but also drives the market's pricing language for crypto companies to migrate more systematically towards a financial institution framework (emphasizing compliance and licensing, risk control and operational resilience, revenue quality and sustainable profits more strongly). In terms of market performance, the 2025 sample generally exhibited a common characteristic of "strong initial offering phase, followed by rapid differentiation": in terms of issuance structure, many companies had relatively tight initial float (in the range of approximately 7.6%–26.5%), making short-term price discovery more elastic when risk appetite windows opened. The secondary market was generally strong on the first day, with some assets experiencing doubling-level repricing and others mostly delivering double-digit positive returns. Many companies continued their strength into the first week and first month, reflecting that buyers had "sustained demand" rather than one-time pricing for such assets during the window. However, after 1–6 months, differentiation became significantly more pronounced, aligning more closely with the traditional risk asset logic of "macro + quality"—companies more reliant on retail and trading-type businesses were more sensitive to risk appetite shifts and experienced faster drawdowns, while assets more focused on upstream infrastructure and institutionalized service capabilities were more likely to receive sustained re-ratings.

Source: nasdaq.com / Total U.S. Stock Crypto Company IPO Proceeds in 2025

More crucially, the reason the "return" of U.S. stock crypto company IPOs was so well-received is essentially because it simultaneously satisfied the three things public markets care most about in a window: buyable, comparable, and exitable. First, it transformed the previously hard-to-access "cash flows of crypto financial infrastructure" into stock assets that traditional accounts can directly hold, naturally fitting the compliance and risk control frameworks of long-term capital like mutual funds, pensions, and sovereign wealth funds. Second, IPOs gave the industry its first batch of horizontally comparable equity samples. Buyers no longer have to rely solely on "narrative strength/trading volume extrapolation" to estimate valuations but can use the familiar language of financial institutions for stratification—compliance costs and licensing barriers, risk provisioning and internal control/governance, client structure and retention, revenue quality and capital efficiency. As pricing methods become more standardized, buyers are more willing to pay a higher certainty premium during the window. Third, IPOs partially migrated the exit mechanism from "on-chain liquidity and sentiment cycles" to "public market liquidity + market making/research coverage + index and institutional rebalancing." This emboldens capital to provide stronger order quality during the issuance phase (including more stable long-term demand and anchor orders), which in turn reinforces the repricing momentum during the initial offering phase. In other words, the enthusiasm is not solely driven by risk appetite but by the decline in risk premium brought about by "institutionalized accessibility": when assets become easier to audit, compare, and incorporate into risk budgets, public markets are more willing to pay a premium for them.

Among these, Circle is the most representative case of a "stablecoin sector equity valuation anchor": its IPO priced at $31, raising approximately $1.054 billion, corresponding to an IPO valuation of about $6.45 billion. The secondary market conducted a strong repricing during the window—approximately +168.5% on the first day, +243.7% in the first week, and +501.9% in the first month, reaching a peak of $298.99 mid-way corresponding to a maximum gain of about +864.5%. Even on a six-month basis, the sample point still showed approximately +182.1%. The significance of Circle lies not in "the gain itself" but in it being the first time "stablecoin" was priced by the market as an auditable, benchmarkable, risk-budget-includable "financial infrastructure cash flow" through public equity, moving away from its past reliance more on on-chain growth narratives. The compliance moat and settlement network effects are no longer just concepts but are directly reflected in the elevation of the valuation benchmark through issuance pricing and sustained secondary market demand. Simultaneously, Circle also validated the typical "buying pattern" of U.S. stocks for such assets—when the window opens, a small float combined with high-quality buyer demand amplifies price elasticity; but after the window contracts, valuations revert more quickly to differentiation based on fundamental delivery, cycle sensitivity, and profit quality. This also forms the core rationale for our optimistic view on U.S. stock crypto company IPOs: public markets will not indiscriminately raise valuations, but they will complete stratification faster and more clearly. Once high-quality assets establish benchmarkable valuation anchors in public markets, their cost of capital will decrease, their refinancing and M&A currency will strengthen, and the virtuous cycle of growth and compliance investment becomes easier to achieve—this is more important than short-term price fluctuations.

Looking ahead to 2026, the market's focus will shift from "whether a window exists" to "whether subsequent listing projects can proceed continuously, forming a more sustained issuance rhythm." Based on current market expectations, potential candidates include Anchorage Digital, Upbit, OKX, Securitize