HIP-3 and Builder Codes: Hyperliquid's Ecosystem Counterattack

- Core Viewpoint: Hyperliquid is seeking long-term dominance through a strategic pivot to B2B.

- Key Elements:

- Market share has fallen from a peak of 80% to approximately 20%.

- Strategic shift towards B2B with the launch of HIP-3 and Builder Codes.

- Competitors are capitalizing on this transition period, using incentives to capture market share.

- Market Impact: Driving the competition towards infrastructure-level development in the decentralized derivatives sector.

- Timeliness Note: Medium-term impact.

Original Title: Hyperliquid Growth Situation

Original Author: @esprisi0

Compiled by: Peggy, BlockBeats

Editor's Note: Hyperliquid once dominated the decentralized derivatives sector, but its market share plummeted sharply in the second half of 2025, raising industry concerns: has it peaked, or is it laying the groundwork for the next phase? This article reviews Hyperliquid's three stages: from extreme dominance with a market share once reaching 80%, to a loss of momentum as strategic shifts and intensified competition drove it down to 20%, and finally to a resurgence centered on HIP-3 and Builder Codes.

The following is the original text:

Over the past few weeks, concerns about Hyperliquid's future have intensified. The loss of market share, rapidly rising competitors, and an increasingly crowded derivatives landscape have raised a critical question: what's really happening beneath the surface? Has Hyperliquid already peaked, or does the current narrative overlook deeper structural signals?

This article will break it down point by point.

Phase One: Extreme Dominance

From early 2023 to mid-2025, Hyperliquid consistently set new all-time highs in key metrics and steadily increased its market share, thanks to several structural advantages:

Points-based incentive mechanisms attracted significant liquidity; first-mover advantage in launching new perpetual contracts (e.g., $TRUMP, $BERA) made Hyperliquid the most liquid venue for new trading pairs and the preferred platform for pre-listing trading (e.g., $PUMP, $WLFI, XPL). To avoid missing emerging trends, traders were forced to flock to Hyperliquid, pushing its competitive advantage to its peak; best-in-class UI/UX experience among all perpetual DEXs; lower fees than centralized exchanges (CEXs); launched spot trading, unlocking new use cases; Builder Codes, HIP-2, and HyperEVM integration; achieved zero downtime even during major market crashes.

Consequently, Hyperliquid's market share grew consecutively for over a year, peaking at 80% in May 2025.

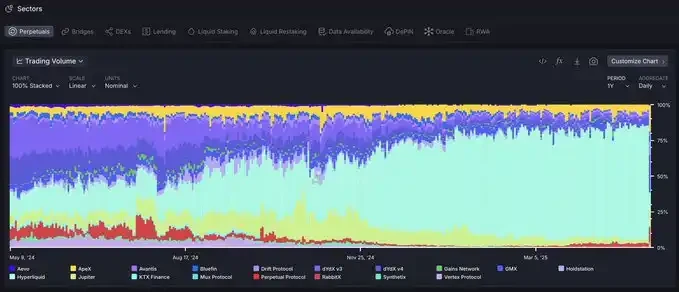

Perpetual trading volume market share data provided by @artemis

During that phase, the Hyperliquid team was clearly ahead of the entire market in terms of innovation and execution speed, with no truly comparable product in the entire ecosystem.

Phase Two: The Rise of the "AWS of Liquidity" and Accelerated Competition

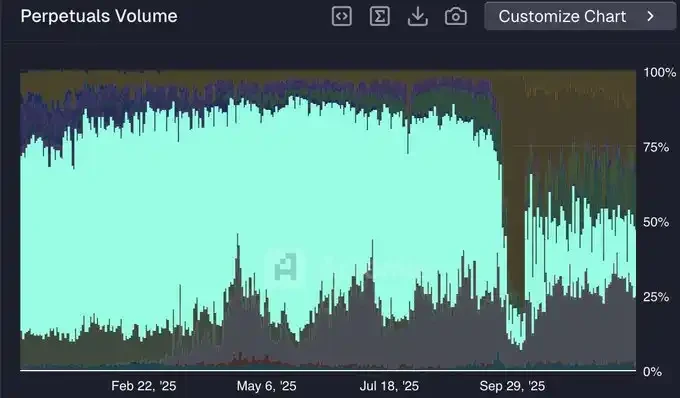

Since May 2025, Hyperliquid's market share has plummeted sharply, dropping from around 80% to close to 20% of trading volume by early December.

@HyperliquidX market share (Data source: @artemis)

This loss of momentum relative to competitors can be attributed to several factors:

Strategic Shift from B2C to B2B

Instead of doubling down on a pure B2C model, such as launching its own mobile app or continuously rolling out new perpetual contract products, Hyperliquid chose to pivot towards a B2B strategy, positioning itself as the "AWS of Liquidity."

This strategy focuses on building core infrastructure for external developers to use, such as Builder Codes for frontends and HIP-3 for launching new perpetual markets. However, this shift inherently delegates the initiative for product deployment to third parties.

In the short term, this strategy is suboptimal for attracting and retaining liquidity. The infrastructure is still in its early stages, adoption takes time, and external developers lack the distribution capabilities and trust that the Hyperliquid core team has built up over the long term.

Competitors Seizing the Opportunity During Hyperliquid's Transition

Unlike Hyperliquid's new B2B model, competitors remain fully vertically integrated, allowing them to move significantly faster when launching new products.

By not needing to delegate execution, these platforms maintain full control over product launches while leveraging their established user trust for rapid expansion. Consequently, they are more competitive than they were in Phase One.

This directly translates into market share gains. Competitors now not only offer all the products available on Hyperliquid but also introduce features not yet available on HL (e.g., Lighter launching spot markets, perpetual stocks, and forex).

Incentives and "Mercenary Liquidity"

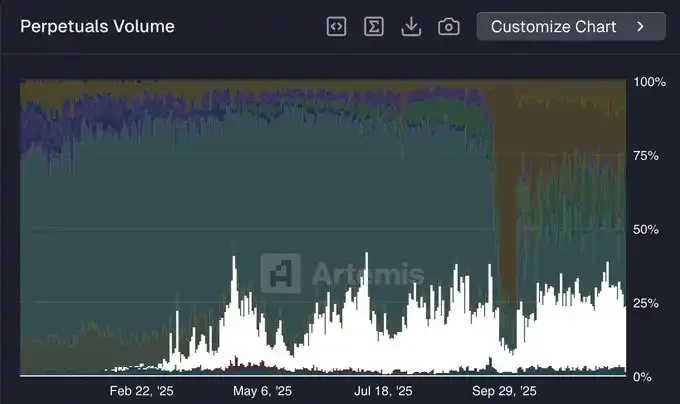

Hyperliquid has not run any official incentive programs for over a year, while its main competitors remain active. Lighter (with ~25% market share recently leading trading volume) is still in its pre-TGE points season.

@Lighter_xyz market share (Data source: @artemis)

In DeFi, liquidity is more "mercenary" than anywhere else. A significant portion of the volume flowing from Hyperliquid to Lighter (and other platforms) is likely incentive-driven, related to airdrop farming. Like most perpetual DEXs running points seasons, Lighter's market share is expected to decline post-TGE.

Phase Three: The Rise of HIP-3 and Builder Codes

As mentioned, building the "AWS of Liquidity" is not the optimal short-term strategy. However, in the long run, this model is precisely what positions Hyperliquid to become a core hub for global finance.

Although competitors have replicated most of Hyperliquid's current features, true innovation still originates from Hyperliquid. Developers building on Hyperliquid benefit from domain specialization, allowing them to craft more targeted product development strategies on top of evolving infrastructure. Conversely, protocols like Lighter that remain fully vertically integrated face constraints when optimizing development across multiple product lines simultaneously.

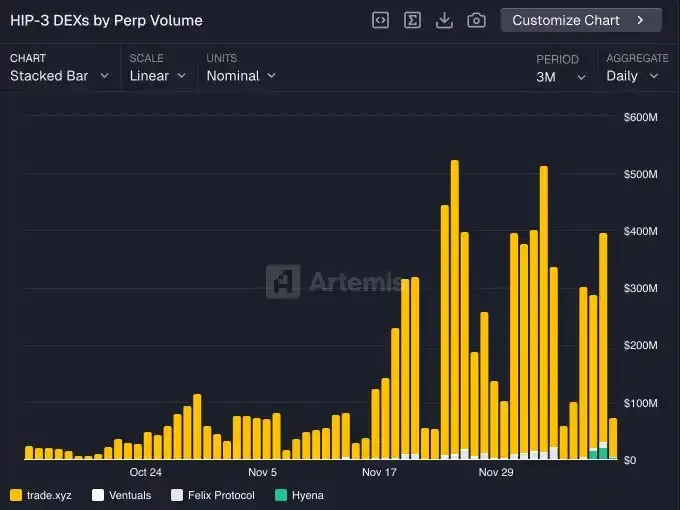

HIP-3 is still in its early stages, but its long-term impact is beginning to show. Key players include:

@tradexyz has launched perpetual stocks

@hyenatrade recently deployed a trading terminal for USDe

More experimental markets are emerging, such as @ventuals offering pre-IPO exposure and @trovemarkets targeting niche speculative markets like Pokémon or CS:GO assets

HIP-3 markets are expected to account for a significant portion of Hyperliquid's total trading volume by 2026.

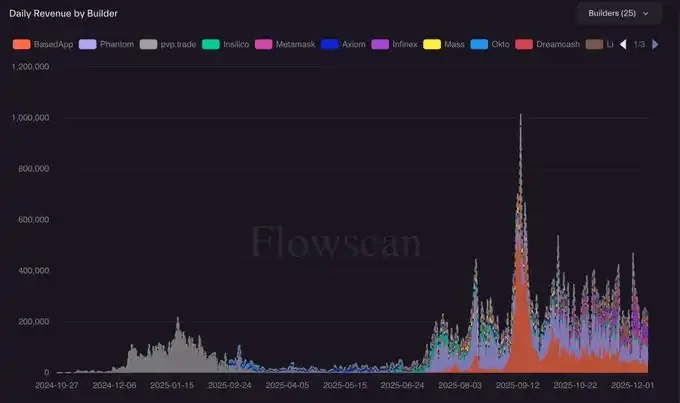

HIP-3 Trading Volume (by Builder)

The key driver that will ultimately propel Hyperliquid back to dominance is the synergy between HIP-3 and Builder Codes. Any frontend integrated with Hyperliquid can instantly access the full suite of HIP-3 markets, offering users unique products.

Therefore, developers have a strong incentive to launch markets via HIP-3, as these markets can be distributed on any compatible frontend (like Phantom, MetaMask, etc.) and tap into entirely new sources of liquidity. It's a perfect virtuous cycle.

The ongoing development of Builder Codes makes me even more optimistic about the future, both in terms of revenue growth and active user growth.

Builder Codes Revenue (Data source: @hydromancerxyz)

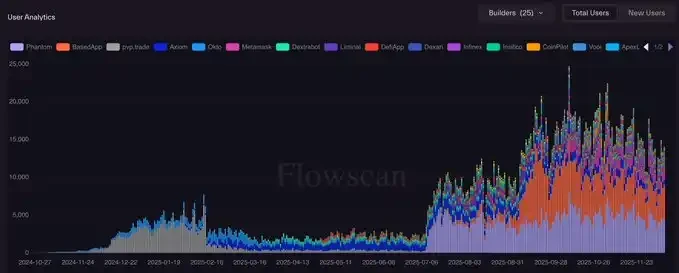

Builder Codes Daily Active Users (Data source: @hydromancerxyz)

Currently, Builder Codes are primarily used by crypto-native applications (e.g., Phantom, MetaMask, BasedApp, etc.). However, I anticipate the emergence of a category of super-apps built on Hyperliquid, designed to attract entirely new, non-crypto-native user bases.

This will likely be the key path for Hyperliquid to enter its next phase of scaling and is the focus of my next article.