Why is the current macro environment favorable for risk assets?

- Core View: Short-term optimism for risk assets, long-term concerns over debt and demographic issues.

- Key Factors:

- AI capital expenditure provides a strong short-term boost to corporate earnings.

- Consumption by the affluent supports nominal growth, masking structural problems.

- Sovereign debt and low fertility rates pose long-term macro risks.

- Market Impact: Short-term positive for tech stocks, long-term vigilance against tail risks is required.

- Timeliness Note: Short-term / Long-term impact.

Original Author: arndxt_xo

Original Compilation: AididiaoJP, Foresight News

Summary in one sentence: I am bullish on risk assets in the short term because AI capital expenditure, consumption driven by the affluent class, and still-high nominal growth are structurally favorable for corporate profits.

Put more simply: When the cost of borrowing becomes cheaper, 'risk assets' typically perform well.

But at the same time, I am deeply skeptical of the story we are currently telling about what all this means for the next decade:

- The sovereign debt problem cannot be resolved without some combination of inflation, financial repression, or unforeseen events.

- Fertility rates and demographics will invisibly constrain real economic growth and quietly amplify political risks.

- Asia, especially China, will increasingly become the core definer of both opportunities and tail risks.

So the trend continues; keep holding those profit engines. But build a portfolio on the premise of recognizing that the path to currency devaluation and demographic adjustment will be full of twists and turns, not smooth sailing.

The Illusion of Consensus

If you only read the views of major institutions, you would think we live in the most perfect macro world:

Economic growth is 'resilient,' inflation is sliding towards target, AI is a long-term tailwind, and Asia is the new diversification engine.

HSBC's latest Q1 2026 outlook is a clear embodiment of this consensus: stay in the equity bull market, overweight technology and communication services, bet on AI winners and Asian markets, lock in investment-grade bond yields, and use alternative and multi-asset strategies to smooth volatility.

I actually partly agree with this view. But if you stop here, you miss the truly important story.

Beneath the surface, the reality is:

- A profit cycle driven by AI capital expenditure, whose intensity far exceeds people's imagination.

- A monetary policy transmission mechanism that is partially broken due to massive public debt piled onto private balance sheets.

- Some structural time bombs—sovereign debt, collapsing fertility rates, geopolitical realignment—that are irrelevant for the current quarter but crucial for what 'risk assets' themselves will mean a decade from now.

This article is my attempt to reconcile these two worlds: one is the glossy, easy-to-sell 'resilience' story, the other is the messy, complex, path-dependent macro reality.

1. Market Consensus

Let's start with the prevailing view among institutional investors.

Their logic is simple:

- The equity bull market continues, but with increased volatility.

- Diversify sector/style: Overweight technology and communications, while allocating to utilities (power demand), industrials, and financials for value and diversification.

- Use alternative investments and multi-asset strategies to hedge against downturns—such as gold, hedge funds, private credit/equity, infrastructure, and volatility strategies.

Focus on capturing yield opportunities:

- Shift funds from high-yield bonds to investment-grade bonds as spreads are already narrow.

- Increase allocations to emerging market hard currency corporate bonds and local currency bonds to capture yield spreads and returns with low correlation to equities.

- Utilize infrastructure and volatility strategies as yield sources that hedge against inflation.

Position Asia as the core of diversification:

- Overweight China, Hong Kong, Japan, Singapore, South Korea.

- Focus on themes: Asia's data center boom, China's innovation leaders, improving Asian corporate returns via buybacks/dividends/M&A, and high-quality Asian credit.

In fixed income, they are explicitly bullish on:

- Global investment-grade corporate bonds for their attractive spreads and the opportunity to lock in yields before policy rates fall.

- Overweight emerging market local currency bonds for yield, potential currency gains, and low correlation with equities.

- Slightly underweight global high-yield bonds due to rich valuations and idiosyncratic credit risks.

This is a textbook 'late-cycle but not over' allocation: ride the trend, diversify, and let Asia, AI, and yield strategies drive your portfolio.

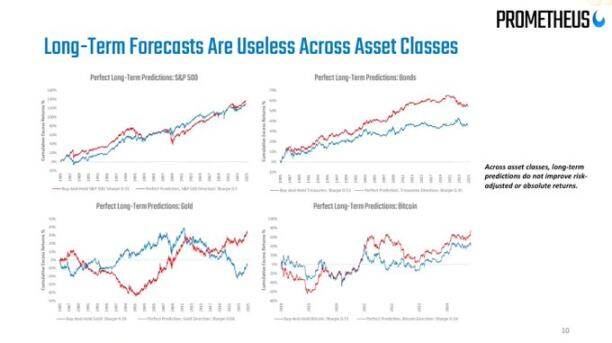

I think this strategy will be broadly correct over the next 6-12 months. But the problem is precisely that most macro analysis stops here, and the real risks begin from this point.

2. Cracks Beneath the Surface

From a macro perspective:

- US nominal spending growth is around 4-5%, directly supporting corporate revenues.

- But the key is: Who is consuming? Where is the money coming from?

Simply discussing the decline in the savings rate ('consumers are out of money') misses the point. If affluent households draw down savings, increase credit, or realize asset gains, they can continue to spend even as wage growth slows and the job market weakens. The portion of consumption exceeding income is supported by the balance sheet (wealth), not the income statement (current income).

This means a significant portion of marginal demand comes from affluent households with strong balance sheets, not from broad-based real income growth.

This is why the data looks so contradictory:

- Overall consumption remains strong.

- The labor market is gradually weakening, especially in low-end jobs.

- Growing income and asset inequality further reinforce this pattern.

Here, I part ways with the mainstream 'resilience' narrative. Macro aggregates look good because they are increasingly dominated by the few at the top of the income, wealth, and capital access pyramid.

For the stock market, this is still a positive (profits don't care if income comes from one rich person or ten poor ones). But for social stability, the political environment, and long-term growth, this is a slow-burning fuse.

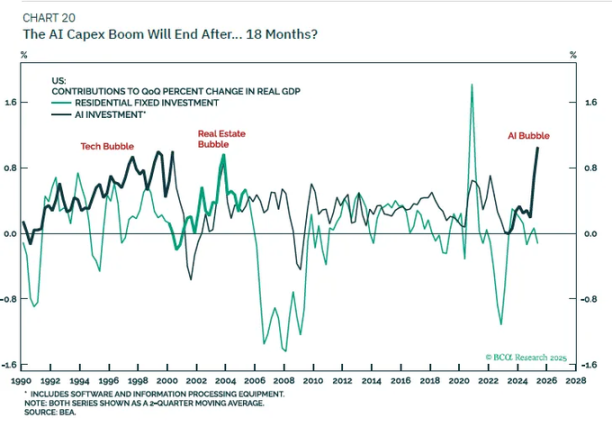

3. The Stimulative Effect of AI Capital Expenditure

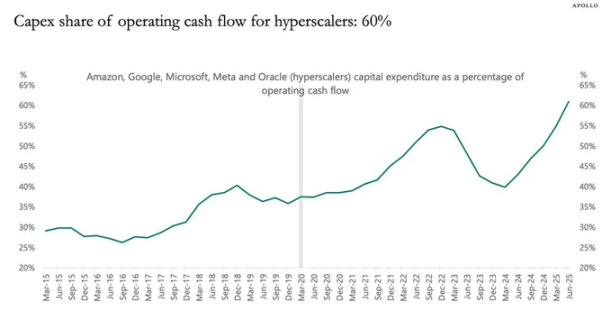

The most underestimated dynamic right now is AI capital expenditure and its impact on profits.

Simply put:

- Investment spending is someone else's revenue today.

- The related costs (depreciation) manifest slowly over many years.

Therefore, when AI hyperscalers and related companies significantly increase total investment (e.g., by 20%):

- Revenue and profits receive a massive, front-loaded boost.

- Depreciation rises slowly over time, roughly in line with inflation.

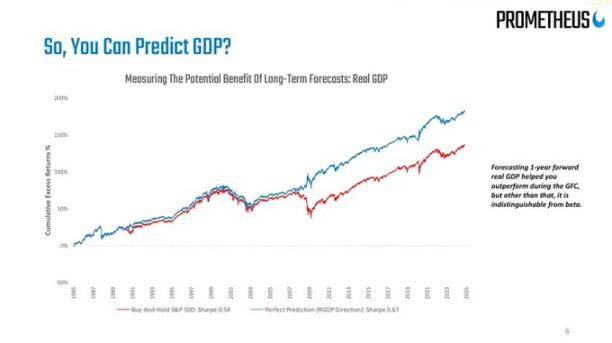

- Data shows that the single best indicator for explaining profits at any point in time is total investment minus capital consumption (depreciation).

This leads to a very simple, yet consensus-divergent conclusion: As long as the AI capex wave continues, it is stimulative for the business cycle and maximizes corporate profits.

Don't try to stop this train.

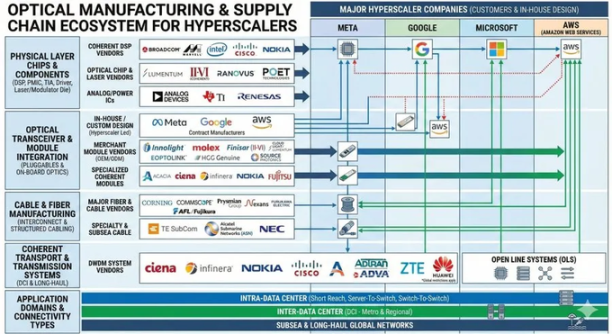

This aligns perfectly with HSBC's overweight on tech stocks and its 'evolving AI ecosystem' theme; they are essentially front-running the same profit logic, albeit phrased differently.

What I am more skeptical about is the narrative regarding its long-term impact:

I don't believe AI capex alone can usher us into a new era of 6% real GDP growth.

Capex will slow once the window for financing via corporate free cash flow narrows and balance sheets become saturated.

As depreciation gradually catches up, this 'profit stimulus' effect will fade; we will revert to the potential trend of population growth + productivity gains, which is not high in developed countries.

Therefore, my stance is:

- Tactically: Remain bullish on beneficiaries of AI capex (chips, data center infrastructure, power grids, niche software, etc.) as long as total investment data keeps soaring.

- Strategically: View this as a cyclical profit boom, not a permanent reset of the trend growth rate.

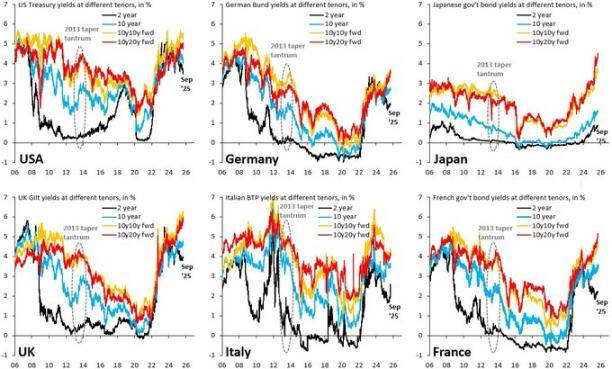

4. Bonds, Liquidity, and the Semi-Broken Transmission Mechanism

This part gets a bit weird.

Historically, a 500 basis point rate hike would severely hit the private sector's net interest income. But now, trillions in public debt sitting on private balance sheets as safe assets distort this relationship:

- Rising rates mean higher interest income for holders of Treasuries and reserves.

- Much corporate and household debt is fixed-rate (especially mortgages).

- The net result: The private sector's net interest burden hasn't deteriorated as macro models predicted.

Thus we face:

- A Fed in a bind: inflation still above target, yet labor data softening.

- A volatile rates market: The best trade this year has been bonds' mean reversion—buying after panic sell-offs, selling after sharp rallies—because the macro environment refuses to crystallize into a clear 'big cuts' or 'hike again' trend.

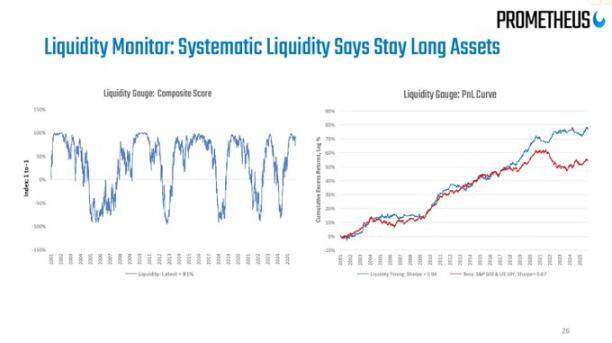

Regarding 'liquidity,' my view is straightforward:

- The Fed's balance sheet is now more of a narrative tool; its net changes are too slow and too small relative to the entire financial system to be an effective trading signal.

- Real liquidity shifts happen in private sector balance sheets and the repo market: who is borrowing, who is lending, and at what spreads.

5. Debt, Demographics, and China's Long Shadow

Sovereign Debt: The Endgame is Known, the Path is Not

The international sovereign debt issue is the defining macro theme of our time, and everyone knows the 'solution' is nothing but:

Reducing the debt/GDP ratio to manageable levels through currency devaluation (inflation).

What remains unresolved is the path:

Orderly financial repression:

- Keep nominal growth > nominal interest rates,

- Tolerate inflation slightly above target,

- Slowly erode the real debt burden.

Messy crisis events:

- Markets panic over runaway fiscal trajectories.

- Term premia suddenly spike.

- Currency crises in weaker sovereigns.

We got a taste of this earlier this year when US long-term yields spiked due to fiscal concerns. HSBC itself noted that the narrative about 'deteriorating fiscal trajectory' peaked around relevant budget discussions, then faded as the Fed pivoted to growth concerns.

I believe this drama is far from over.

Fertility Rates: A Macro Crisis in Slow Motion

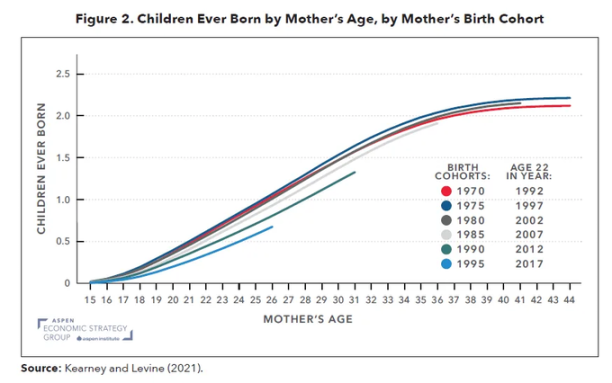

Global fertility rates falling below replacement level is not just a European and East Asian problem; it has now spread to Iran, Turkey, and is gradually affecting parts of Africa. This is essentially a profound macro shock disguised by demographic numbers.

Low fertility means:

- Higher dependency ratios (a larger proportion of people to support).

- Lower long-term real economic growth potential.

- Long-term social distribution pressures and political tension as returns to capital persistently outpace wage growth.

When you combine AI capex (a shock of capital deepening) with falling fertility (a shock to labor supply),

You get a world where:

- Capital owners nominally perform extremely well.

- Political systems become more unstable.

- financeinvestpolicy