What exactly is Twitter's "poison pill plan" to resist Musk's hostile takeover?

This article comes from nytimesThis article comes from

, Original author: Amanda Hol puch, compiled by Odaily translator Katie Ku.

This corporate defense mechanism was developed in the 1980s when corporate leaders faced corporate acquirers and hostile takeovers in an attempt to protect their businesses from being acquired by other individuals, businesses, or groups.

secondary title

What is the "Poison Pill"?

"The idea is to make the board's bid more attractive than the acquirer's," said Carliss Chatman, an associate professor of law at Washington and Lee University. Have leverage when planning direct negotiations with potential acquirers.

secondary title

What is the specific content of the "poison pill plan"?

The official name of a "poison pill" is a shareholder rights plan, which can appear in a company's articles of association or bylaws, or exist as a contract between shareholders. There are different types of poison pills, but typically they allow certain shareholders to buy additional shares at a discount, said Ann Lipton, an associate professor of law at Tulane University. "

The only shareholders who are prevented from making these discounted acquisitions of stock are the ones who trigger the "poison pill." A "poison pill" is triggered when the stake owned by one person (usually the acquirer) reaches a threshold. If the shares they own reach that threshold, the value of their shares is suddenly diluted by other shareholders buying at a discount.

Securities experts say investors rarely try to break through the "poison pill" threshold, but there are exceptions.

In July 2018, pizza chain Papa John's adopted a "poison pill," a rare case of trying to thwart a takeover by its founders. The company's founder, John Schnatter, resigned after reports said he used a racial slur during a conference call, a statement he later said in court had been misinterpreted. He owned 30% of the company at the time.

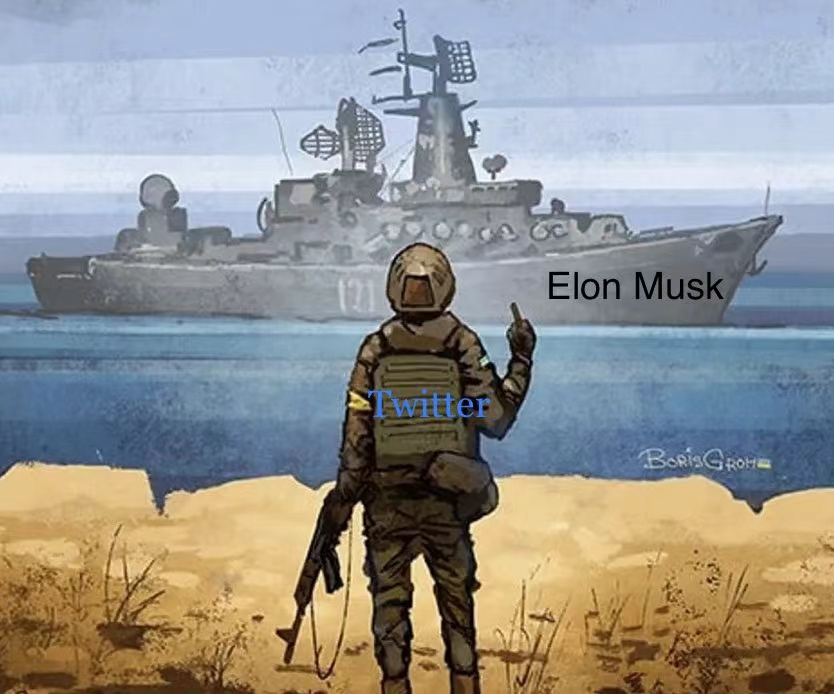

In Twitter's case, if Musk, or any other individual or team, worked together to buy 15% or more of Twitter's shares, it would inject a significant amount of new shares into the market. And immediately dilute Musk's stake and make it more difficult to acquire a sizable percentage of the company. Musk currently owns more than 9% of Twitter.

secondary title

What are the restrictions on using the Poison Pill?

Ann Lipton, an associate professor of law, said a company may be limited by a cap on the number of shares it is allowed to issue, as set out in its bylaws. But even if that ceiling is reached, companies have other options to make acquisitions unattractive, she said.

“Boards have a lot of leeway in judging what is in the best interest of shareholders, especially if they are made up of independent directors,” she said. Boards often implement “poison pills” on an ad hoc basis so they can have more Take more time to consider your options.

secondary title

According to associate professor of law Carliss Chatman, the "poison pill" is very important. Hostile takeovers are less common than they were in the 1980s, she said, because potential suitors now know a company has a "poison pill" in place.

secondary title

Examples of the use of "poison pills"

In November 2012, Netflix successfully blocked the investment of billionaire investor Carl Icahn. The company employs a "poison pill" strategy. Acquiring 10% of Netflix without board approval would have cost Carl Icahn, or any other individual or group, much more to acquire a larger stake.