Terra's road to self-help: from algorithmic stablecoins to BTC reserve stablecoins

Algorithmic stablecoins have always been a very controversial topic in the industry. Is it really possible to create a digital currency with stable value and not linked to other assets?

In November last year, Assistant Professor Ryan Clements from the University of Calgary School of Law published a paper entitled "Built to Fail: The Inherent Fragility of Algorithmic Stablecoins"The paper begins by stating:

“Algorithmic stablecoins are inherently fragile, unsecured digital assets that attempt to use financial engineering, algorithms, and market incentives to anchor the price of a reference asset, they are not stable at all, but in a permanently vulnerable state.

The paper argues that algorithmic stablecoins are fundamentally flawed because they rely on three factors that history has shown to be uncontrollable. First, they require a certain level of demand support for operational stability. Second, they rely on independent players with market incentives for price stability arbitrage. Finally, they need reliable price information readily available. None of these factors are certain, and all of them are historically vulnerable in times of financial crisis or extreme volatility. All forms of stablecoins require regulatory guidance, including issuer registration requirements, clear classification, collateral custody, transparency safeguards, and risk disclosure and containment measures.

Algorithmic stablecoins in particular require a robust regulatory framework, including risk disclosure and containment safeguards, and currently they only serve speculative DeFi trading applications with little social or financial inclusion value. "

image description

(Figure: The Death Spiral of Algorithmic Stablecoins)

However, Terra (Luna), the most popular stability calculation project at present, is shown in front of everyone with a very eye-catching performance. Does it really achieve the stable calculation goal? Or is it that Terra (Luna) will inevitably collapse and eventually become a "Ponzi scheme"?

In the thesis of Professor Ryan Clements, he also focused on the Terra (Luna) project. The following is his description:

"Terra's creator, Terraform Labs, has recently received a significant amount of venture capital backing and significant investor interest. Terra uses its governance token, LUNA, which is issued with a built-in money supply and economic incentives, including fees and arbitrage opportunities. An algorithmic stablecoin pegged to the South Korean Won.

These stablecoins are then used as payment mechanisms in the growing Terraform Labs financial ecosystem, which includes Mirror, a protocol for creating synthetic assets that tracks U.S. stocks, futures and ETFs, Anchor, a lending and savings platform, and Chai, a collaborative payments platform. . In addition, Terra also plans to add DeFi asset management, other lending protocols, and decentralized leverage insurance protocols to this budding ecosystem.

Terra's stablecoin is the "core" that connects the emerging financial "infrastructure," which includes the aforementioned e-commerce payments, synthetic stocks, exchange-traded funds, derivatives and other financial assets, savings, and lending applications. Terra incentivizes independent traders to buy its stablecoin, in exchange for LUNA if the stablecoin falls below the peg rate. The stability of Terra stablecoins goes beyond DeFi speculation, and given their many applications in the Terra economy, these algorithmic stablecoins also directly impact the economic prospects of many businesses and consumers.

For this ecosystem to continue to be viable, there must be a permanent level of demand for the Terra stablecoin and its governance token, LUNA. In other words, there must be enough arbitrage activity between the two tokens, there must be enough transaction fees in the Terra ecosystem, and there must be enough mining demand in the network. The mainstreaming of stablecoins as transactional currencies, along with the ability to “stake” them and earn rewards, creates “network effects” and long-term incentives to maintain and maintain the ecosystem, the Terra founders claim.Therefore, Terra's bet that 'financial applications using stablecoins on the network will drive permanent demand' is uncertain. Historically, Terra stablecoins have also experienced deviations from the anchor.image description”

Note: For the specific mechanism of Terra and its UST, you can refer to this article "What is Terra (LUNA)?》

Doesn't Terraform Labs know the risks here? Of course not, on the contrary, as system designers and operators, they are fully aware of the huge risks involved in the entire system.

simply put,

simply put,

, but note that this is still only a prototype.

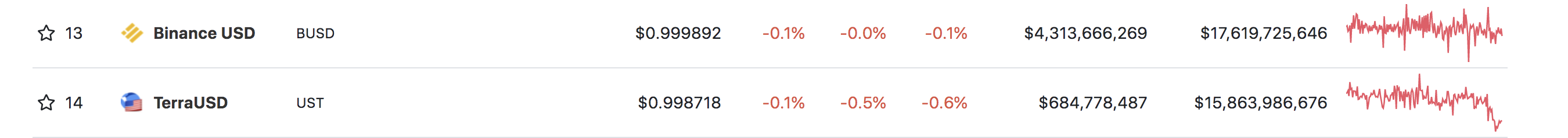

image description

(data from coingecko.com)

In the entire stablecoin market, the market value of UST is second only to Tether (USDT), USDC and BinanceUSD, but unlike these centralized stablecoins that are backed by fiat currency, the additional issuance of UST is achieved by burning the system’s governance token LUNA Yes, but as Professor Ryan Clements said, even though Terraform Labs has created a huge ecology for UST, this approach is still accompanied by huge risks.

So, in order to defuse the risk, Terra turned to use Bitcoin as collateral for UST.

Today, the Luna Foundation reserves more than $3 billion worth of Bitcoin, USDT, and LUNA, and the project is slowly converting most of it into Bitcoin.

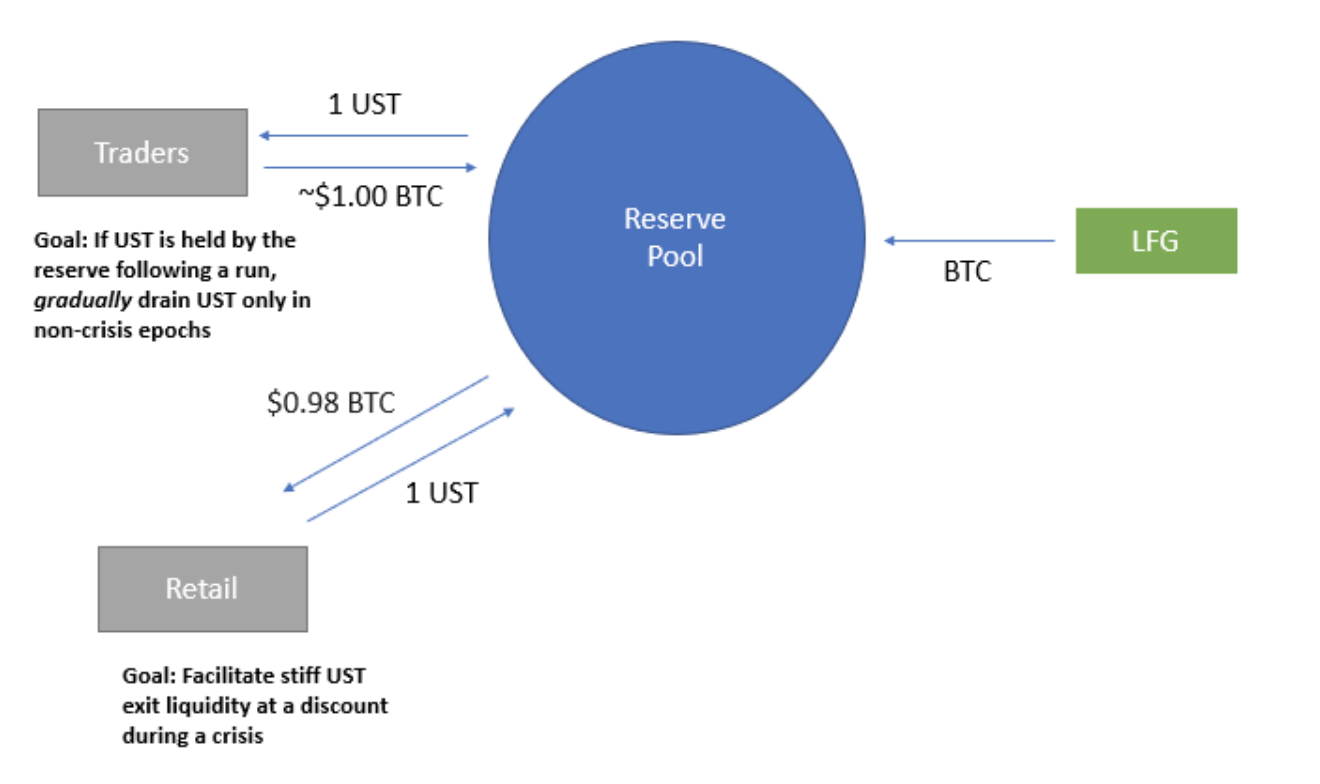

governance proposalgovernance proposal, this Bitcoin reserve pool will be used to support UST immediately when UST deviates downwards, avoiding unanchored situations, and relying on traders to replenish BTC reserves after the crisis is resolved.

As for the new UST release, the Terra team may also change the practice of burning 100% LUNA.

Instead, Terra may burn 60% of LUNA and use 40% of it to buy Bitcoin.

For example, suppose I want UST worth $10,000 in mint. What I burn now is not LUNA worth $10,000, but LUNA worth $6,000. The remaining LUNA worth $4,000 will be used by the Terra team to buy bitcoin. (Note: This is just a guess at the moment and has not been confirmed yet)

This dual strategy will slowly expand the Luna Foundation’s bitcoin reserves. Of course, compared with UST’s current reserve value of 3 billion U.S. dollars and the market value of 15 billion U.S. dollars, it is obviously impossible to achieve a 100% reserve guarantee, but in theory , assuming that the price of Bitcoin can continue to rise, then the value of the Luna Foundation’s BTC reserves may be consistent with the value of UST, or even exceed the value of UST for a long enough period of time (of course, this is only an idealized speculation).

So what kind of impact will Terra's approach bring?

First of all, Terra is becoming a consistent buyer of Bitcoin, you can think of Terra as a new demand for Bitcoin, and eventually Terra may also become one of the organizations with the largest Bitcoin holdings.

Secondly, Terra is emphasizing the merits of the Bitcoin reserve stablecoin, and Do Kwon elaborated on the view that "Bitcoin is the hardest and most decentralized asset in the world", which creates a symbiotic relationship between UST and BTC, At the same time, part of the risk is transferred to BTC.

Do a simple arithmetic problem: Assuming that the UST circulation market value remains unchanged, and the Luna Foundation currently converts the US$3 billion reserve into BTC, then when the BTC price increases to US$220,000, the BTC mortgage rate of UST will exceed 100%, but since the BTC reserves of UST and the Luna Foundation may both continue to grow, the actual situation will be more complicated.

Third, the Terra ecosystem will become an L2 layer of Bitcoin.

Of course, even if Terra can theoretically resolve system risks by virtue of the rise in the price of Bitcoin, it must also build a safe bridge between Bitcoin and its ecosystem. In addition, we also need to assume that the Terra Foundation will not do evil .

Finally, I would like to talk about some personal superficial views:

It is impossible for an algorithmic stablecoin without external collateral to achieve stability. This is like the fact that a "perpetual motion machine" cannot achieve perpetual motion without the injection of external energy;

It is necessary for Terra to turn to Bitcoin reserves, which is to defuse risks, but its own risks are still very large at present;

Assuming that one day the value of Bitcoin reserved by Terra can approach or even exceed the market value of UST, and can be exchanged well, the entire ecology of Terra will become extremely dominant;

Relevant information:

Relevant information:

1、https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3952045

2、https://agora.terra.money/c/governance/13

3、https://www.defidaonews.com/article/6738234